Are you ready to become a homeowner?

We specialized in first-time homebuyers, second homes, investments, and other loan products. My two decades of experience will ease your worries. Inquire about the best home loan programs in Texas that we can offer.

For Questions, Kindly fill-out the "Q&A with Broker"

form

Ready to apply? Click "Apply Now" to start the process

Because It’s Time To Seek Financial Assistance From an Expert

Down-payment Assistance

Inquire now for the assistance program

Fixed-rate Loans

Fixed-rate conventional mortgages

Specialty Loans

ITIN, Non-QM Loans

Hablamos Español

De nemos expertas que su idioma

Whatever the case may be, it's best that you inquire and talk to me. Let's see how I can help you and explore your options.

What are the Common Loan Programs?

Inquire for the best loan options that you can get.

FHA Home Loan

FHA home loans are mortgages which are insured by the Federal Housing Administration (FHA), allowing borrowers to get low mortgage rates with a minimal down payment.

VA Loans

The VA Loan provides veterans with a federally guaranteed home loan which requires no down payment. This program was designed to provide housing and assistance for veterans and their families.

USDA Loans

If you're looking to buy a home in a rural or suburban area with no down payment and minimal investment, you might consider the USDA Rural Development Loan.

Jumbo Loans

Jumbo Loans are used to finance properties that are too expensive for a conventional conforming loan. There's maximum amount for a conforming loan as determined by the Federal Housing Finance Agency (FHFA).

With me, there's no compromise.

2 Decades of experience

As an experienced loan officer in Texas, you can count on me to guide you through the mortgage process. Whether you are a first-time homebuyer, a current homeowner wanting to refinance an existing mortgage or add an investment property to your rental portfolio, my focus is on providing a five-star customer experience. Texans Mortgage Group - powered by Barrett Financial offers competitive interest rates and a wide range of loan products from fixed-rate conventional mortgages to FHA, VA, Jumbo loans as well as down-payment assistance programs.

NMLS# 262973 Co. NMLS #181106

No-hassle loan applications

Step-by-step guide in closing your loans

Home buying journey in 5 simple steps!

01: Find Out How Much you can Borrow

The first step in obtaining a loan is to determine how much money you can borrow. In case of buying a home, you should determine how much home you can afford even before you begin looking. By answering a few simple questions, we will calculate your buying power, based on standard lender guidelines.

02

: Select the right loan program

Home loans come in many shapes and sizes. Deciding which loan makes the most sense for your financial situation and goals means understanding the benefits of each.

03

: Apply for a loan

After figuring out which loans is the most beneficial for you. You can go ahead and start the application process.

04

: Begin loan processing

Although lenders conform to standards set by government agencies, loan approval guidelines vary depending on the terms of each loan.

05

: Close your loan

After your loan is approved, you are ready to sign the final loan documents. You must review the documents prior to signing and make sure that the interest rate and loan terms are what you were promised.

No Compromise, Just Maximize

Read our guides and more -- check out our blogs!

What is an FHA Loan? Spanish Guide (Bilingual Mortgage Broker)

“Dreams don't work unless you take action. The surest way to make your dreams come true is to live them.” - Roy T. Bennett

Introduction:

Are you a first-time homebuyer or looking for a mortgage option with lower down payment requirements? Our latest blog post is here to unravel the intricacies of FHA loans, providing you with a comprehensive understanding of this popular home financing option. In this article, we'll walk you through the basics of FHA loans, shedding light on how they work, their advantages, and the key factors that determine your eligibility. Si prefieres hablar en español y te sientes más cómodo en este idioma, soy un profesional bilingüe en español y estoy listo para asistirte. Desplázate hacia abajo y llena el formulario.

What Are FHA Loans?

An FHA loan stands as a mortgage that gains the backing of the Federal Housing Administration (FHA), a governmental body responsible for establishing regulations governing the construction and financing of homes across the United States.

When a mortgage is FHA-insured (also known as FHA-backed or FHA-guaranteed), it signifies that in the unfortunate event of a foreclosure, the FHA intervenes to shoulder a portion or the entirety of the lender's financial losses. This additional layer of security translates into reduced interest rates and more accessible down payment prerequisites for these loans.

To qualify for an FHA loan, certain borrower criteria must be met, encompassing a minimum credit score of 500 and a down payment ranging from 3.5% to 10%. This commitment to borrower-friendly terms makes FHA loans a promising avenue for those embarking on their homeownership journey.

Are there types of FHA loans?

FHA loans are available with both fixed-rate and adjustable-rate alternatives. With a fixed-rate loan, the interest rate remains constant throughout the loan term, while an adjustable-rate mortgage comes with an interest rate that may change over time.

Moreover, FHA mortgage plans cater to specific intentions, these are:

FHA Purchase Loan or 203(b) loans: his is the standard FHA loan used to purchase a primary residence. It offers a low down payment requirement as low as 3.5%, making homeownership more achievable for first-time buyers or those with limited funds for a down payment.

FHA 203(k) Rehabilitation Loan: If you're eyeing a fixer-upper, the FHA 203(k) loan might be your solution. This loan bundles the home purchase and renovation costs into a single mortgage, streamlining the process of turning a house into your dream home.

FHA Streamline Refinance Loan: For those who already have an FHA loan, the streamline refinance option offers a simplified way to refinance without a full credit check or extensive documentation. It's ideal for reducing monthly payments or switching from an adjustable-rate mortgage to a fixed-rate one.

FHA Energy Efficient Mortgage (EEM): If you're interested in making your home more energy-efficient, the EEM loan allows you to finance energy-efficient improvements alongside your home purchase or refinance.

FHA Cash-Out Refinance Loan:Need funds for significant expenses? This loan allows you to tap into your home's equity and receive cash in exchange for refinancing your mortgage.

FHA Reverse Mortgage: Designed for homeowners aged 62 and older, this loan enables you to convert part of your home's equity into cash. You don't need to make monthly mortgage payments; instead, the loan is repaid when the home is sold.

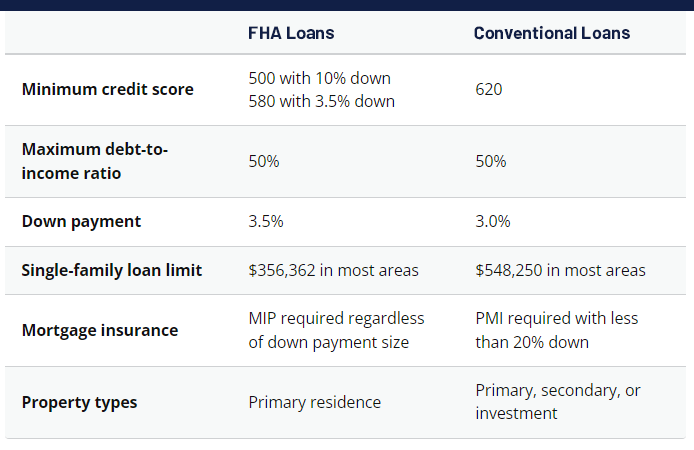

FHA vs. Conventional Loans:

When considering FHA loans in comparison to conventional loans, it's important to note that FHA loans are often more suitable for those with lower credit scores and first-time homebuyers. Conversely, conventional loans tend to align well with borrowers boasting higher credit scores or individuals involved in real estate investment. To offer a clearer understanding, let's delve into a detailed comparison of these two mortgage options:

How to Apply for an FHA Loan:

These are the necessary steps for you to get an FHA loan:

1. Get Pre-Approved: The process of mortgage pre-approval varies based on the lender or platform you choose. Generally, it entails furnishing essential details. You can get started by filling-out this form here.

2. Complete the Lender's Loan Application and Undergo a Credit Check: This step involves a more comprehensive application compared to pre-approval. You may need recent pay stubs and bank statements for precise completion.

3. Submit Financial Documentation: Include recent pay stubs, W-2s, tax returns, and bank statements among other documents. Your loan officer will guide you regarding the specific paperwork required.

4. Await Property Appraisal: This step verifies whether your chosen home's value corresponds with the loan amount. The appraiser will also assess if the property aligns with FHA construction standards.

5. Stay in Contact with Your Loan Officer: Throughout the mortgage processing and underwriting phases, your loan officer might request additional paperwork. Keeping communication open ensures a smooth process.

6. Closing Appointment: This entails settling your closing costs and down payment, and obtaining your keys to the property.

Conclusion:

Let's unlock Homeownership Opportunities with a Bilingual Spanish Mortgage Loan Broker here in Texans Mortgage Group - Your Trusted Partner in Securing Financial Freedom. Reach out to me anytime for expert assistance tailored to your needs!

Are you ready to get started? Fill-out the form below.

Disclaimer: This content is intended for general information purposes and not as personalized financial advice. For tailored guidance, consult with the experts at Texans Mortgage Group.

Aliquam Venenatis, Sapien

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Duis imperdiet nisi ac augue element

Aliquam Venenatis, Sapien

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Duis imperdiet nisi ac augue element

Aliquam Venenatis, Sapien

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Duis imperdiet nisi ac augue element

Aliquam Venenatis, Sapien

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Duis imperdiet nisi ac augue element

Hear What Our Clients Say

Reviews were imported from Google & Facebook

Jackeline Deleon Gonzalez

The best trio! I had the pleasure of working with Patricia and she has been of great assistance throughout the entire process. Even after we closed on our home she is there to answer any questions. Highly recommended, the best. Rudy and Team, thank you!!!

Jen Perez

Rudy and the staff are so nice you get the good vibe when you walk in very sweet front desk girl I’m very blessed to have friends like Rudy se los recomiendo *5

Angie Zamora

Rudy and the rest of the staff are so helpful and welcoming. They make you feel like family even after the whole process is over. Everyone knows that the home buying process is not a walk in the park, it’s stressful, it’s frustrating at times but with Texas Mortgage Lender you never feel that way. They help you every step of the way, best decision I ever made. I have been in my home since 2017.

Ernesto Ortega

Best customer service at this location

Address: 711 W Bay Area Blvd. Ste 286, Webster, TX 77598

COMPANY NMLS: 181106

RUDY ZARATE | NMLS #262973 | Barrett Financial Group, L.L.C. | NMLS #181106

View complaint policy at www.barrettfinancial.com/texas-complaint

This is not a commitment to lend. All loans are subject to credit approval.

Our Houston, TX Office:

(281) 747-6699

Our McAllen, TX Office:

(956) 255-0454

Operating Hours:

Mon 08:30 am – 05:30 pm

Tue 07:30 am – 04:30 pm

Wed 07:30 am – 04:30 pm

Thu 08:30 am – 05:30 pm

Fri 07:30 am – 04:30 pm

Weekends Closed